What are Connecticut car registration fees and how much do they typically cost? Connecticut car registration fees are government-imposed charges for the privilege of operating a motor vehicle on public roads. The cost varies significantly based on factors like vehicle type, weight, age, and whether you’re registering a new or used car, transferring plates, or dealing with an expired registration.

Navigating the world of vehicle registration in Connecticut can sometimes feel like a puzzle. One of the most common questions drivers have is about the cost. This comprehensive guide aims to demystify Connecticut car registration fees, breaking down the expenses for various scenarios. Whether you’re a new resident, buying a new or used car, or simply renewing your existing registration, knowing what to expect financially is key. We’ll delve into the specifics of Connecticut DMV registration fees, helping you budget effectively for your automotive needs.

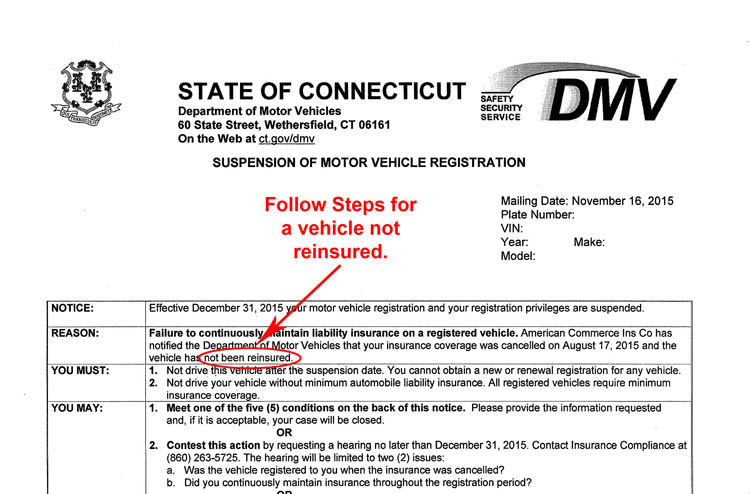

Image Source: portal.ct.gov

Deciphering Annual Vehicle Registration Cost CT

The core of vehicle ownership in Connecticut involves an annual fee to keep your car legally on the road. This annual vehicle registration cost CT is a recurring expense that every registered vehicle owner must pay. The amount isn’t a flat rate; it’s calculated based on several critical factors, primarily the type and weight of your vehicle.

Factors Influencing Your Annual Bill

Several elements contribute to the final figure you’ll see on your registration bill. It’s important to consider these when estimating your costs:

- Vehicle Type: Cars, trucks, motorcycles, and commercial vehicles all have different fee structures.

- Vehicle Weight: Heavier vehicles generally incur higher registration fees than lighter ones. This is often because they are perceived to cause more wear and tear on roadways.

- Vehicle Age: While not always a direct factor in the initial calculation for standard passenger vehicles, older vehicles might sometimes have different classifications or exemptions.

- Purpose of Use: Personal use vehicles are typically charged differently than commercial vehicles.

Standard Passenger Vehicle Registration Fees

For most passenger cars, the Connecticut DMV registration fees are primarily weight-based. The state categorizes vehicles into different weight classes. Generally, the heavier the vehicle, the higher the fee.

Example of Weight-Based Fees (Illustrative – Actual Fees May Vary):

| Vehicle Weight Class | Approximate Fee Range (Annual) |

|---|---|

| Light (e.g., compact cars) | \$35 – \$60 |

| Medium (e.g., sedans, SUVs) | \$60 – \$90 |

| Heavy (e.g., larger SUVs, minivans) | \$90 – \$120 |

Please note: These are illustrative figures. The Connecticut DMV website or your local branch will have the most up-to-date and precise fee schedule.

The process usually involves bringing your vehicle to an inspection station to determine its weight, which then dictates the specific registration fee.

New Car Registration Fees Connecticut

When you drive a brand-new car off the lot, you’ll need to handle the initial registration process. The new car registration fees Connecticut involve several components beyond just the annual registration cost itself. You’ll also likely encounter sales tax and potentially other administrative fees.

The Initial Purchase and Registration

Upon purchasing a new vehicle, the dealership often assists with the initial registration process. However, it’s essential to understand the individual costs involved:

- Sales Tax: Connecticut has a state sales tax on motor vehicles. This is calculated as a percentage of the vehicle’s purchase price. The current rate should be confirmed with the DMV or your dealer, as tax rates can change.

- Registration Fee: This is the standard fee based on the vehicle’s weight, as discussed earlier.

- Title Fee: There’s a fee for issuing a new title for your vehicle.

- License Plate Fee: You’ll pay a fee for your initial set of license plates.

Estimating Your New Car Outlay

To estimate your total cost for a new car registration, consider:

- Vehicle Price: This is the base for sales tax calculation.

- Sales Tax Rate: Multiply the vehicle price by the current sales tax rate.

- Weight-Based Registration Fee: Determine your vehicle’s weight class and find the corresponding fee.

- Title and Plate Fees: These are fixed amounts.

It’s always wise to ask the dealership for a detailed breakdown of all fees before signing any paperwork.

Used Car Registration Cost CT

Registering a used car involves a similar process to a new one, but with a few key differences, particularly concerning sales tax and the title. The used car registration cost CT will depend on whether you purchased from a dealer or a private seller, and the vehicle’s current registration status.

Key Differences for Used Vehicles

- Sales Tax on Private Sales: While dealers typically collect sales tax at the point of sale, private sales require you to pay the sales tax directly to the DMV when you register the vehicle. The tax is usually applied to the purchase price or the book value of the vehicle, whichever is higher.

- Transferred Registrations: If the previous owner has an active registration, you might be able to transfer the plates, potentially saving on initial plate fees, but you will still need to pay your portion of the registration fee.

- Inspection Requirements: Used vehicles often require a safety inspection before registration can be completed, especially if they haven’t been registered in Connecticut recently or are coming from out of state.

Fees Associated with Used Car Registration

The cost components for a used car typically include:

- Registration Fee: Based on the vehicle’s weight.

- Sales Tax: Calculated on the purchase price or book value.

- Title Fee: For the transfer of ownership.

- License Plate Fee: If you need new plates or are transferring from another state.

- Inspection Fees: If applicable.

It’s crucial to have all necessary paperwork from the seller, including a bill of sale and the vehicle’s title, to ensure a smooth registration process.

Motorcycle Registration Fees CT

Motorcycles have their own specific fee structure within the Connecticut DMV. The motorcycle registration fees CT are generally lower than those for cars, but they are still a necessary expense for legal operation.

Motorcycle Specific Charges

The fees for registering a motorcycle are typically based on the motorcycle’s engine displacement or a flat rate, rather than weight.

- Annual Registration Fee: This is the primary charge for operating a motorcycle.

- Title Fee: A fee applies for the motorcycle title.

- Plate Fee: For the license plates.

The DMV provides a clear schedule for motorcycle registration costs, which are usually a fixed amount per year for standard motorcycle registrations.

Commercial Vehicle Registration CT

Operating a commercial vehicle in Connecticut comes with a different set of rules and higher fees. Commercial vehicle registration CT costs are influenced by the vehicle’s gross weight rating (GWR) and its intended commercial use.

Higher Fees for Commercial Use

Commercial vehicles, such as trucks, vans used for business, and other heavy-duty vehicles, are subject to fees that reflect their potential impact on roads and infrastructure.

- Weight-Based Fees: Fees for commercial vehicles are often significantly higher than for passenger cars and are directly tied to their GWR. The heavier the vehicle, the higher the fee.

- Type of Commercial Use: Certain types of commercial operations might have additional fees or classifications.

- Federal Regulations: Some commercial vehicles may also need to comply with federal regulations, which can involve separate registration or permitting fees.

Commercial Registration Components

The costs for commercial registration can include:

- Annual Registration Fee: Based on GWR and vehicle type.

- Weight Tax: Often a separate component for heavier commercial vehicles.

- Commercial Plates: Specific plates are issued for commercial use.

- Title and Other Administrative Fees: Similar to personal vehicles.

For businesses, budgeting for commercial vehicle registration is a significant operational expense that needs careful consideration.

Fees for Transferring Plates CT

If you sell a vehicle or buy a new one and want to keep your existing license plates, you’ll need to go through the process of transferring plates. The fees for transferring plates CT are usually modest compared to initial registration but are still a necessary part of the process.

The Plate Transfer Process

Transferring plates allows you to avoid paying for a new set of plates. The primary cost associated with this is typically a transfer fee charged by the DMV.

- Transfer Fee: A small administrative fee is charged to process the transfer of your plates to a new vehicle.

- Registration Adjustment: You will need to pay the difference in registration fees if the new vehicle falls into a higher weight class or has a different registration structure than the old one. Conversely, if the new vehicle is lighter, you typically won’t receive a refund for the difference.

- Title Transfer: You’ll also pay the standard fee for transferring the title to the new vehicle.

When transferring plates, ensure you have the old plates with you when you visit the DMV, along with all the necessary paperwork for the new vehicle.

Expired Registration Fees CT

Driving with an expired registration in Connecticut is a serious offense that can lead to significant penalties. The expired registration fees CT include not only the standard registration cost but also late fees and potentially other fines.

Penalties for Late Registration

The Connecticut DMV imposes penalties for operating a vehicle with an expired registration.

- Late Fees: These are additional charges that accrue the longer your registration is expired.

- Fines: Law enforcement can issue tickets and fines for expired registration.

- Reinstatement Fees: If your registration has lapsed significantly, you may face additional reinstatement fees to get back on the road legally.

It is crucial to renew your registration before it expires to avoid these additional costs and potential legal complications. The DMV typically sends out renewal notices in advance, but it is the owner’s responsibility to ensure timely renewal.

Registration Renewal Cost Connecticut

Keeping your vehicle legally registered involves an annual renewal process. The registration renewal cost Connecticut is generally the same as the initial annual registration fee, based on your vehicle’s weight and type.

The Annual Renewal Process

The renewal process is designed to be straightforward for most vehicle owners.

- Renewal Notice: The DMV will send you a renewal notice by mail or email.

- Fee Payment: You will pay the calculated registration fee.

- Inspection: Depending on the age and type of your vehicle, you may need to pass a safety and/or emissions inspection before you can renew.

The cost of renewal is primarily the same as your previous year’s registration, assuming no changes to your vehicle or its classification. However, it’s always a good idea to check your renewal notice for any updated fees or requirements.

Specialty License Plate Fees CT

Connecticut offers a variety of specialty license plates, often supporting charitable causes, universities, or specific interests. These specialty license plate fees CT come with an additional cost on top of your standard registration fees.

Options for Personalized Plates

- Standard Specialty Plates: Many organizations offer plates with designs that benefit their cause. These usually have an annual surcharge.

- Vanity Plates: You can also opt for custom “vanity” plates where you choose your own letter and number combination. These also incur an extra fee.

The exact cost for specialty and vanity plates varies, so it’s best to consult the Connecticut DMV website for the most current pricing. These extra fees are paid annually with your registration renewal.

Summary of Registration Fee Components

To provide a clearer picture, let’s summarize the various fees you might encounter:

- Base Registration Fee: Determined by vehicle type and weight.

- Sales Tax: Paid on purchase of new or used vehicles (unless exempt).

- Title Fee: For issuing or transferring vehicle titles.

- License Plate Fee: For the initial set of plates.

- Transfer Fee: For moving plates to a different vehicle.

- Late Fees/Penalties: For expired registrations.

- Inspection Fees: For required safety or emissions inspections.

- Specialty/Vanity Plate Surcharges: For optional personalized plates.

Frequently Asked Questions (FAQ)

Q1: How do I find out the exact registration fee for my car in Connecticut?

A1: The most accurate way is to visit the Connecticut Department of Motor Vehicles (DMV) website. They have tools and fee schedules that allow you to calculate your specific registration cost based on your vehicle’s details. You can also contact a local DMV branch.

Q2: Are there any exemptions from paying Connecticut car registration fees?

A2: Certain vehicles, like those owned by municipalities, state governments, or specific non-profit organizations, may be exempt. There are also exemptions for certain types of antique or classic vehicles, but these often have specific conditions and requirements.

Q3: What happens if I don’t pay my Connecticut registration fees on time?

A3: Driving with an expired registration can result in fines, late fees, and your vehicle being impounded. It’s crucial to renew your registration before it expires to avoid these penalties.

Q4: Can I register a car in Connecticut if I don’t live there?

A4: Generally, you must be a Connecticut resident to register a vehicle in the state. If you move to Connecticut, you typically have a limited time (e.g., 30 or 60 days) to register your out-of-state vehicle.

Q5: What documents do I need to register a vehicle in Connecticut?

A5: You will typically need proof of identity (like a driver’s license), proof of insurance, the vehicle’s title (or a bill of sale if it’s a new vehicle), and the completed registration application form. Specific requirements can vary, so checking the CT DMV website is advised.

By familiarizing yourself with these various fees and processes, you can better manage the financial aspects of owning and operating a vehicle in Connecticut.