Yes, you can generally purchase a car while in Chapter 13 bankruptcy, but it’s not as simple as walking into a dealership and signing on the dotted line. The process requires permission from the bankruptcy court and your trustee.

Navigating the waters of Chapter 13 bankruptcy can feel like steering a ship through choppy seas. Amidst the complex rules and regulations, a common question arises: “Can I buy a car while I’m in Chapter 13?” The straightforward answer is yes, but it comes with significant caveats and a structured procedure. This guide aims to demystify the process of buying a car Chapter 13, explore your options for auto loan Chapter 13, and help you understand how to go about getting a car Chapter 13.

Image Source: www.stoneroselaw.com

Why You Might Need a Car During Chapter 13

Life doesn’t stop just because you’ve filed for bankruptcy. Essential needs remain, and for many, a reliable vehicle is paramount for daily life. This includes:

- Commuting to Work: A car is often necessary to earn income, which is crucial for making your Chapter 13 repayment plan car payments.

- Essential Errands: Groceries, doctor’s appointments, and taking children to school are all daily realities that a car facilitates.

- Vehicle Replacement: If your current car is unreliable, unsafe, or has broken down beyond repair, obtaining a replacement becomes a necessity.

The Crucial Role of the Chapter 13 Trustee

Your Chapter 13 trustee plays a vital role in any major financial decision, including a Chapter 13 bankruptcy car purchase. The trustee oversees your bankruptcy case, ensuring that you adhere to the terms of your repayment plan and that your creditors are treated fairly.

- Gatekeeper of Major Purchases: Any significant purchase, especially one involving financing like a Chapter 13 car loan, requires the trustee’s approval.

- Ensuring Reasonableness: The trustee will assess if the vehicle purchase is a necessity and if the cost is reasonable and affordable within your bankruptcy plan. They are there to protect the interests of your creditors.

- Budget Review: The trustee will examine your proposed car purchase in the context of your overall budget and your ability to continue making your Chapter 13 payments.

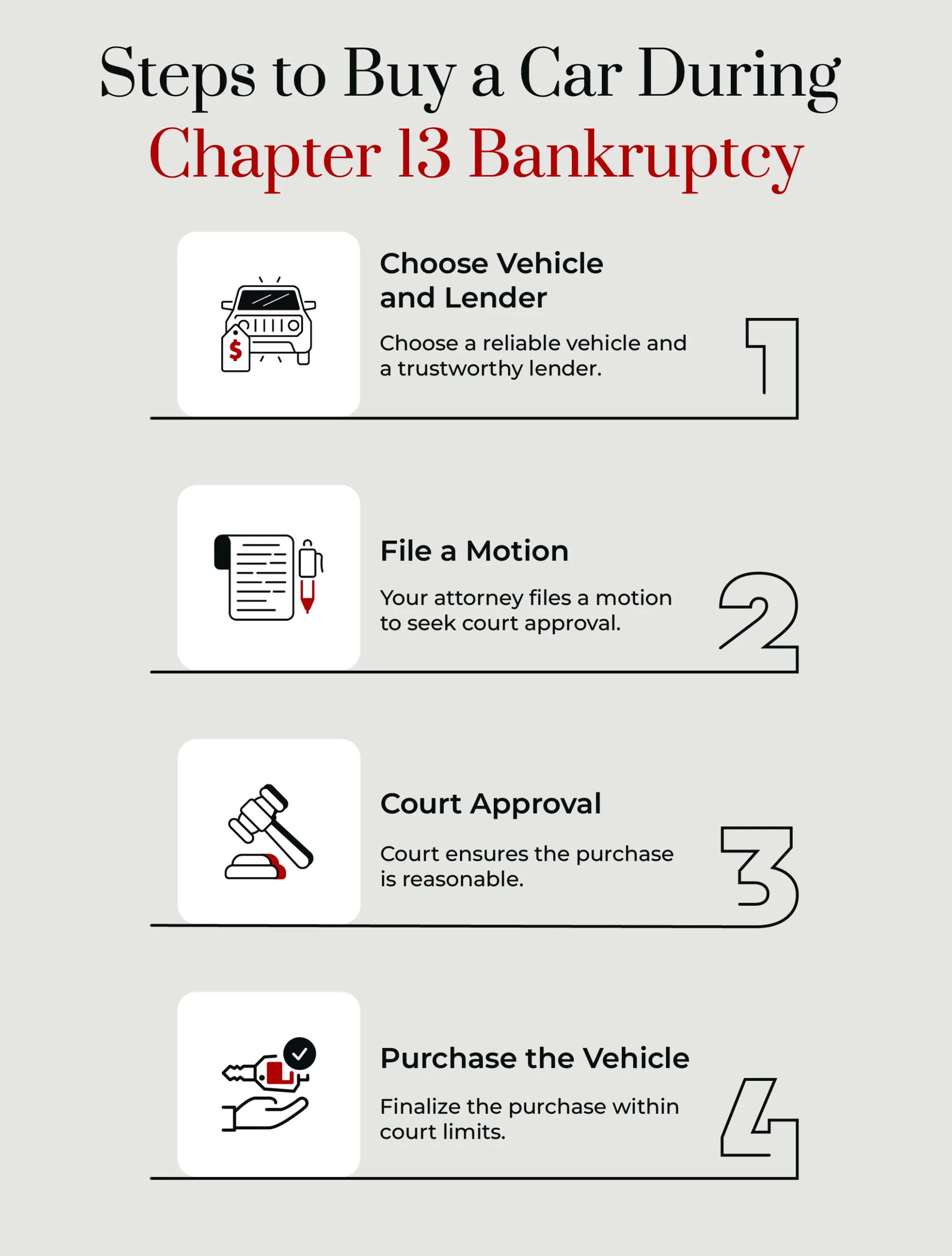

Obtaining Court and Trustee Approval

Before you can even think about test driving a vehicle, you must secure permission. The process typically involves these steps:

- File a Motion with the Court: You will need to file a formal “Motion to Incur Debt” or a similar motion with the bankruptcy court. This motion will detail your need for the vehicle, the proposed purchase price, the terms of the financing (if applicable), and how it fits into your budget.

- Notify the Trustee: A copy of this motion must be served on your Chapter 13 trustee.

- Trustee’s Review and Recommendation: The trustee will review your motion. They may have questions or require additional documentation, such as proof of income, expenses, and details about the vehicle you intend to purchase. The trustee will then file a recommendation with the court – either supporting or objecting to your motion.

- Court Hearing (if necessary): In some cases, the court may schedule a hearing to consider your motion. You or your attorney will need to attend this hearing to explain why the purchase is necessary and affordable.

- Court Order: If the court approves your motion, it will issue an order allowing you to proceed with the purchase and obtain the auto loan Chapter 13.

Important Note: It is highly advisable to consult with your bankruptcy attorney throughout this process. They can guide you on the specific requirements in your jurisdiction and help you prepare the necessary documentation.

Navigating the World of Chapter 13 Car Loans

Securing financing for a vehicle during Chapter 13 can be challenging due to your bankruptcy filing. Lenders may be hesitant, but it’s not impossible. Understanding the types of Chapter 13 car loan options available is key.

“Get-Acquainted” Loans

Some lenders specialize in working with individuals in bankruptcy. These are often referred to as “get-acquainted” loans.

- Purpose: These loans are designed to help individuals re-establish creditworthiness while in a Chapter 13.

- Terms: They may come with higher interest rates and shorter repayment terms than traditional car loans.

- Approval Process: Approval is usually contingent on court and trustee permission.

Dealers Specializing in Bankruptcy Financing

Certain car dealerships cater to buyers with less-than-perfect credit or those undergoing bankruptcy.

- Services: They often have established relationships with lenders who understand Chapter 13.

- Vehicle Selection: They may offer a range of used car Chapter 13 options, as these are often more affordable and easier to finance.

Financing Through Your Chapter 13 Plan

In some instances, your bankruptcy attorney might be able to negotiate with the trustee to include the purchase of a necessary vehicle within your Chapter 13 repayment plan.

- Necessity is Key: This is typically only considered if the vehicle is absolutely essential for your employment and there are no other viable transportation options.

- Court Approval: This would still require court approval and specific structuring within your plan.

Key Considerations When Buying a Car Chapter 13

When you’re ready to embark on your Chapter 13 bankruptcy car purchase, keeping certain factors in mind will streamline the process and increase your chances of success.

The Affordability Test: A Crucial Factor

The most critical element the court and trustee will consider is whether you can afford the vehicle and its associated costs.

- Monthly Payment: This includes the loan payment, insurance, fuel, maintenance, and registration.

- Impact on Your Plan: They will evaluate if taking on this new debt will jeopardize your ability to meet your existing Chapter 13 obligations. Your budget must clearly demonstrate that you can handle these additional expenses.

Vehicle Type and Cost

The type of vehicle you choose matters.

- Necessity vs. Luxury: The court will look favorably on a purchase that addresses a genuine need for reliable transportation. A basic, reliable sedan is more likely to be approved than a luxury SUV or a sports car.

- Used vs. New: A used car Chapter 13 is often a more practical and readily approved option. It’s generally less expensive, leading to a smaller loan amount and lower monthly payments, making it easier to fit into your budget.

- Reasonable Price: The purchase price must be considered “reasonable” for the type of vehicle and its condition. Excessive spending can lead to a denial.

What Information You’ll Need to Provide

Be prepared to present detailed information to your trustee and the court. This often includes:

- Proof of Income: Pay stubs, tax returns.

- Proof of Expenses: Bank statements, utility bills, current debt obligations.

- Vehicle Details: Make, model, year, mileage, purchase price, VIN.

- Financing Details: Loan amount, interest rate, term, monthly payment.

- Justification for Need: Explanation of why the car is essential for your employment or daily life.

What to Avoid

- Impulse Purchases: Do not buy a car without obtaining proper approval. Doing so could lead to serious consequences, including dismissal of your bankruptcy case.

- Overspending: Stick to a budget and avoid cars with excessive features or luxury options.

- Misrepresenting Information: Always be truthful and transparent in all your filings and communications.

Buying a Car Without a Loan: A Different Path

If you have the funds available, purchasing a car outright (paying cash) can be a simpler path during Chapter 13, though it still requires careful consideration and often trustee approval.

Paying Cash for a Car

If you have saved money or received an inheritance that you wish to use for a car purchase, this generally still requires trustee and court approval.

- Source of Funds: You will need to demonstrate the source of the funds. If the funds are part of your disposable income, the trustee will want to ensure that your Chapter 13 plan is not negatively impacted.

- Motion Still Required: You will likely still need to file a motion with the court to explain the proposed use of funds for the vehicle purchase. The trustee will review whether this expenditure is reasonable and necessary and if it affects your ability to fund your repayment plan.

- Avoiding New Debt: This method avoids the complexities of car financing Chapter 13 and the need for a Chapter 13 car loan, which can be beneficial.

The Impact of Your Chapter 13 Repayment Plan Car

Your Chapter 13 repayment plan car is not just about acquiring a vehicle; it’s about integrating that expense and responsibility into your ongoing bankruptcy.

Adjusting Your Budget

If you are approved for a car purchase, you will need to demonstrate to the court and trustee how the new expenses will be managed. This might involve:

- Reducing Other Expenses: Identifying areas in your budget where you can cut back to accommodate the car payment, insurance, and running costs.

- Demonstrating Affordability: Your proposed budget must clearly show that you can continue to meet all your Chapter 13 payments and other essential living expenses.

Long-Term Implications

- Successful Completion: Successfully managing a car payment during Chapter 13 shows financial responsibility, which can improve your credit score over time and contribute to the successful completion of your bankruptcy.

- Potential for Modification: In some cases, if your financial situation changes, you might need to seek a modification of your Chapter 13 plan to adjust payments due to the car expense.

Can I Buy a New Car Chapter 13?

While purchasing a new car Chapter 13 is possible, it is often more difficult to get approved than buying a used car.

- Higher Cost: New cars are significantly more expensive, leading to larger loan amounts and higher monthly payments. This makes it harder to prove affordability to the court and trustee.

- Depreciation: New cars depreciate rapidly, which can be a concern for lenders and the court when assessing the value of the collateral.

- Focus on Necessity: If you are seeking to buy a new car, you will need a very strong justification demonstrating why a used vehicle is not a suitable alternative. This might include specific job requirements or the unsuitability of older models for your needs.

Table: Comparing Used vs. New Car Purchase During Chapter 13

| Feature | Used Car Chapter 13 | New Car Chapter 13 |

|---|---|---|

| Cost | Generally lower purchase price | Significantly higher purchase price |

| Loan Amount | Typically smaller loan needed | Often larger loan required |

| Monthly Payment | Lower monthly payments | Higher monthly payments |

| Affordability | Easier to demonstrate affordability to court/trustee | More challenging to demonstrate affordability |

| Approval Likelihood | Higher | Lower |

| Depreciation | Less of an immediate concern | Rapid depreciation can be a factor for approval |

| Typical Justification | Basic transportation needs | Strong necessity for specific job functions, no suitable used alternatives |

The Role of Your Bankruptcy Attorney

Your bankruptcy attorney is your most valuable ally when attempting to purchase a car during Chapter 13.

Expertise and Guidance

- Navigating Procedures: They know the specific procedures and requirements in your jurisdiction for seeking permission for a Chapter 13 bankruptcy car purchase.

- Filing Motions Correctly: They will draft and file the necessary motions with the court and ensure all parties are properly notified.

- Negotiation: They can negotiate with the trustee on your behalf to support your request.

- Budget Review: They can help you create a realistic budget that demonstrates your ability to afford the vehicle.

Strategic Advice

- Vehicle Selection: They can advise you on the types of vehicles and price ranges that are most likely to receive approval.

- Financing Options: They can help you explore different car financing Chapter 13 options and understand the terms.

Frequently Asked Questions (FAQ)

Q1: Can I buy a car with a Chapter 13 car loan without telling my trustee?

No, absolutely not. You must get permission from the bankruptcy court and your Chapter 13 trustee before purchasing a car or taking on any new debt. Failure to do so can lead to severe consequences, including the dismissal of your bankruptcy case.

Q2: What if my current car breaks down and I need a replacement immediately?

Even in an emergency, you need to contact your bankruptcy attorney immediately. They can help you expedite the process of filing a motion for an emergency vehicle purchase, but it’s still a formal legal process.

Q3: Will my Chapter 13 repayment plan car payments be higher than a regular car payment?

Potentially, yes. Lenders may charge higher interest rates for auto loan Chapter 13 due to the perceived risk associated with bankruptcy filers. However, focusing on a used car Chapter 13 and negotiating a reasonable price can help keep payments manageable.

Q4: What if the trustee objects to my car purchase?

If the trustee objects, you or your attorney will have the opportunity to present your case to the court. The court will then make a final decision based on the presented evidence and arguments.

Q5: Can I buy a car for someone else while in Chapter 13?

Generally, you cannot use your Chapter 13 filing to finance a car for someone else, especially if you are not co-signing or if the purchase is not for a dependent. The purchase must be for your own necessary use.

Q6: How long does it take to get approval for a car purchase in Chapter 13?

The timeline can vary significantly depending on your jurisdiction, the court’s schedule, and how quickly you and your attorney can prepare and file the necessary documentation. It can range from a few weeks to several months.

Q7: What are the best ways to find a lender for a Chapter 13 car loan?

Look for lenders who specialize in bankruptcy financing or who have experience with getting a car Chapter 13. Your bankruptcy attorney may have recommendations for reputable dealers or finance companies.

Conclusion

Purchasing a car while in Chapter 13 bankruptcy is a complex but achievable goal. It requires careful planning, transparency with your trustee and the court, and often the expert guidance of a bankruptcy attorney. By understanding the requirements, focusing on necessity and affordability, and following the proper procedures for obtaining a Chapter 13 car loan, you can successfully navigate this process and secure the transportation you need. Remember, the key is to demonstrate to the court and your trustee that the purchase is a reasonable and necessary expense that will not hinder your ability to complete your Chapter 13 repayment plan car.