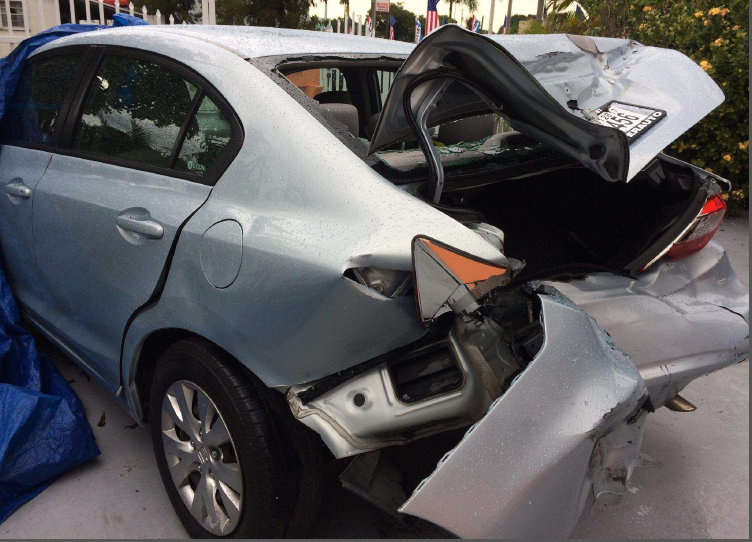

Yes, a car absolutely can be totaled from a rear-end collision. While it might seem like just a “bump” in some cases, the severity of rear-end impact can lead to significant damage, making the vehicle totaled from collision. When repair costs exceed a certain percentage of the car’s pre-accident value, an insurance company will often declare it a total loss, meaning it’s a rear-end collision write-off.

Image Source: www.jahlawfirm.com

Fathoming Total Loss: The Basics

A car is considered “totaled” when the car repair cost vs value makes it uneconomical to fix. Insurance companies use a specific formula to determine if a vehicle is a total loss. This isn’t just about the visible damage; it’s about the underlying structural integrity and the expense to restore it to a safe and drivable condition. A seemingly minor rear-end accident can trigger a chain reaction of damage that significantly impacts the vehicle’s value and repairability.

What Does “Totaled” Really Mean?

When your car is declared a total loss by your insurer, it means they’ve determined that the cost to repair the rear-end accident damage would be more than the car’s actual cash value (ACV) right before the crash. This total loss determination is a critical point in the claims process. You won’t be getting your car back to be repaired by the insurance company; instead, they will pay you the ACV of the car, and they will typically take possession of the damaged vehicle.

The Threshold for Totaling

The exact percentage of repair cost versus vehicle value that triggers a total loss varies by state and by insurance company. However, a common threshold is when repair costs reach 70-80% of the car’s pre-accident market value. Some states have stricter regulations, while others are more lenient.

Deciphering Rear-End Accident Damage

The nature and extent of rear-end accident damage are crucial in determining if a car will be totaled. Even a low-speed impact can cause surprising problems.

Invisible Wounds: Beyond the Bumper

It’s easy to focus on the dented bumper or cracked taillight after a rear-end collision. However, the real concern lies beneath the surface.

Frame Damage

One of the most significant issues stemming from rear-end impacts is vehicle structural damage, specifically to the frame. The frame is the backbone of your car, supporting critical components like the engine, suspension, and body.

- Impact Transfer: Even a seemingly minor rear-end impact can transmit force through the chassis. This force can bend, twist, or weaken the frame rails, unibody structure, or crossmembers.

- Unibody vs. Body-on-Frame: Modern cars largely use unibody construction, where the body and frame are integrated. Damage to one section can compromise the entire structure. Older, body-on-frame vehicles have a separate chassis, which might be more robust but can still suffer damage.

- Repair Complexity: Repairing a damaged frame is incredibly difficult and expensive. It often requires specialized equipment like frame straightening machines. Even after repairs, the structural integrity might never be fully restored, making the vehicle unsafe.

Suspension and Drivetrain Issues

The impact force can also jolt the suspension and drivetrain components.

- Suspension: Control arms, shock absorbers, springs, and steering components can be bent, broken, or misaligned. This can lead to poor handling, uneven tire wear, and an unsafe ride.

- Drivetrain: The transmission, differential, axles, and even the engine mounts can be affected. A jarring impact could damage internal transmission components or crack the transmission housing.

Other Internal Damage

Beyond the frame and suspension, other vital systems can be compromised:

- Exhaust System: The catalytic converter, muffler, and pipes are often located towards the rear of the vehicle and can be crushed or damaged.

- Fuel Tank and Lines: While designed to withstand some impact, a severe rear-end collision can damage the fuel tank or lines, creating a fire hazard.

- Electrical Systems: Rear sensors, taillight wiring, trailer wiring harnesses, and even the battery, if located in the rear, can be damaged, leading to electrical gremlins.

Factors Affecting Totaling a Car in a Rear-End Collision

Several key factors influence whether a car will be deemed a total loss after a rear-end accident.

The Role of Vehicle Value

The car repair cost vs value is the primary driver.

- Actual Cash Value (ACV): This is what your car was worth just before the accident. It’s determined by factors like the car’s make, model, year, mileage, condition, and any optional features.

- Repair Estimates: The body shop provides a detailed estimate of the cost of repairing rear-end damage. This includes parts, labor, paint, and any associated costs.

- The 70-80% Rule (and variations): If the repair estimate (often plus the cost of a rental car during repairs and potential diminished value) exceeds this percentage of the ACV, it’s usually a total loss.

Severity of Rear-End Impact: A Closer Look

The force of the collision plays a direct role in the extent of the damage.

- Speed of Impact: Higher speeds translate to greater impact forces. A 5 mph bumper tap is unlikely to total a modern car, but a 30 mph impact can cause extensive damage.

- Vehicle Size and Weight: A smaller car rear-ending a larger vehicle, or vice versa, will experience different damage patterns and severity. The heavier vehicle often absorbs less impact force.

- Type of Vehicles Involved: The materials and construction of both vehicles matter. A collision involving a large truck and a small sedan will likely result in a totaled sedan.

- Angle of Impact: A direct, perpendicular impact can cause different damage than an angled hit.

Age and Condition of the Vehicle

Older cars and those with pre-existing conditions are more susceptible to being totaled.

- Depreciation: Older cars naturally have a lower ACV. This means that even moderate repair costs can quickly exceed their value.

- Existing Wear and Tear: A car with high mileage, previous unrepaired damage, or worn-out components might already be close to its economic limit for repairs. A rear-end collision could be the final straw.

- Availability of Parts: For older or less common vehicles, finding replacement parts can be difficult and expensive, further increasing repair costs and the likelihood of a total loss.

Insurance Company Policies

Each insurance totaled car policy has its own nuances.

- State Regulations: As mentioned, state laws dictate minimum requirements for total loss declarations.

- Company Guidelines: Insurers have internal guidelines and adjusters who assess the damage. Their interpretation of the repair costs versus value can vary.

- Salvage Value: The insurance company will also consider the salvage value of the damaged car. If the cost to repair is close to the ACV minus the salvage value, they may lean towards totaling it.

The Process: From Collision to Total Loss Determination

When a rear-end collision occurs, a specific process unfolds if the damage is significant.

Initial Assessment and Estimates

- First Notice of Loss (FNOL): You report the accident to your insurance company.

- Damage Inspection: An insurance adjuster will inspect your vehicle to assess the rear-end accident damage.

- Repair Estimates: You may take your car to a body shop for an estimate, or the insurance company might use its network of preferred shops.

The Total Loss Calculation

The insurance adjuster compiles all the information:

- Vehicle’s ACV: Determined through market research and valuation tools.

- Repair Cost Estimate: Includes all necessary parts and labor to fix the vehicle structural damage and other issues.

- Salvage Value: The estimated amount the insurance company can get by selling the wrecked car to a salvage yard.

The core calculation often looks something like this:

ACV – Salvage Value = Maximum Repair Cost Allowed

If the cost of repairing rear-end damage exceeds this “maximum repair cost allowed,” the car is typically declared a total loss.

What Happens When Your Car is Totaled?

If your car is declared a total loss, you’ll typically have a few options:

- Accept the Settlement: The insurance company pays you the ACV, minus your deductible. They then take ownership of the wrecked vehicle.

- Buy Back the Salvage: You can choose to keep the totaled car. The insurance company will deduct the salvage value from your settlement. You will then be responsible for repairing the vehicle yourself and will receive a salvaged title. This is often not recommended for safety reasons, especially with significant structural damage.

- Negotiate the ACV: If you believe the ACV offered is too low, you can present evidence (e.g., advertisements for similar vehicles for sale in your area) to negotiate a higher settlement.

Can You Negotiate a “Total Loss” Decision?

Sometimes, the initial total loss determination might feel incorrect. Here’s how you can approach it:

Challenging the ACV

- Research Market Value: Use online valuation tools (Kelley Blue Book, Edmunds, NADA Guides) and look at local listings for similar vehicles in comparable condition.

- Document Condition: Gather evidence of your car’s excellent condition (maintenance records, recent upgrades) that might increase its value.

Challenging the Repair Estimate

- Get Multiple Estimates: If you disagree with the insurance company’s repair estimate, get estimates from other reputable body shops.

- Review the Estimate Thoroughly: Ensure all necessary repairs, including those for vehicle structural damage and hidden issues, are included.

The Implications of a Rear-End Collision Write-Off

A rear-end collision write-off has significant financial and practical implications.

Financial Impact

- Loss of Value: Even if repaired, a car with a history of significant damage, especially structural damage from a rear-end collision, will have diminished value.

- Replacement Costs: You’ll need to purchase a new vehicle or a replacement, which can be a substantial expense.

- Loan/Lease Payoff: If you have a loan or lease on the totaled car, the insurance payout might not be enough to cover the outstanding balance, especially if you owe more than the car’s ACV (this is where GAP insurance becomes crucial).

Safety Concerns

- Compromised Structural Integrity: Even after professional repairs, a car with previously damaged structural components may not perform as well in future collisions. Safety systems like airbags and crumple zones might be compromised.

- Long-Term Reliability: Hidden damage can lead to recurring mechanical issues, increasing the cost of repairing rear-end damage over time.

Frequently Asked Questions (FAQ)

Q1: If my car is totaled from a rear-end collision, does the insurance pay for a rental car?

Generally, if your car is drivable after a covered rear-end accident damage incident, the insurance company might not pay for a rental. However, if they deem it a total loss and are processing your claim, they typically provide a rental car allowance or a rental vehicle until your claim is settled, or until you receive your settlement check, depending on the policy and circumstances.

Q2: What is diminished value after a rear-end collision?

Diminished value refers to the loss in your car’s market value due to it having been in an accident, even if it’s perfectly repaired. A car with a clean history is worth more than one that has undergone significant repairs, especially for vehicle structural damage. Some policies may cover diminished value, particularly if the other party was at fault, but it’s often an out-of-pocket expense for the vehicle owner unless specific coverage is in place.

Q3: Can a minor rear-end bump total my car?

While less common, a minor rear-end bump can technically total a car if the vehicle has a very low Actual Cash Value (ACV) and the repair estimate, even for seemingly minor rear-end accident damage, happens to exceed a significant percentage of that low ACV. For example, if your car is only worth $2,000 and the repairs (even for a bent bumper and misaligned exhaust) come to $1,500, it might be considered a total loss. However, for most modern vehicles with a reasonable ACV, a minor bump usually won’t result in a rear-end collision write-off.

Q4: What if my car is totaled, but I still owe money on it?

If your car is totaled and you have a loan or lease, the insurance payout (ACV) will first go towards paying off the lender. If the ACV is less than the amount you owe, you will still be responsible for the remaining balance. This is where GAP (Guaranteed Asset Protection) insurance is invaluable, as it covers this difference.

Q5: How does the insurance company determine the Actual Cash Value (ACV) of my totaled car?

Insurance companies typically use specialized valuation software that considers your car’s make, model, year, mileage, condition, options, and recent sales data for comparable vehicles in your geographic area. They aim to determine what your car would have sold for on the open market just before the accident.

Q6: Can I keep my totaled car after a rear-end collision?

Yes, you can often choose to keep your car even after it’s declared a total loss. This is known as “buying back the salvage.” The insurance company will deduct the car’s salvage value from your settlement check. However, you will then receive a salvaged or rebuilt title, and you will be responsible for all repairs. It’s crucial to consider the safety and roadworthiness implications before choosing this option, especially with significant vehicle structural damage.

Conclusion

The question of whether a car can be totaled from a rear-end collision is a definitive yes. The severity of rear-end impact, coupled with the vehicle’s value and existing condition, dictates the outcome. What might appear as minor cosmetic damage can often mask extensive vehicle structural damage and mechanical issues, pushing the car repair cost vs value beyond economical limits. When an insurer declares a car a total loss due to a rear-end incident, it signifies a rear-end collision write-off, leading to a payout of the vehicle’s ACV and the transfer of ownership of the damaged car. It’s essential to be informed about the total loss determination process and your rights as a policyholder to navigate these challenging situations effectively.