Yes, you can generally keep your car if you file Chapter 13 bankruptcy, provided you can afford to catch up on missed payments and continue making your regular car payments as part of your repayment plan. This is one of the primary benefits of Chapter 13, often referred to as a “wage earner’s plan.” This guide will delve into the specifics of how Chapter 13 bankruptcy allows you to protect your vehicle.

Image Source: www.therollinsfirm.com

Keeping Your Car in Chapter 13 Bankruptcy

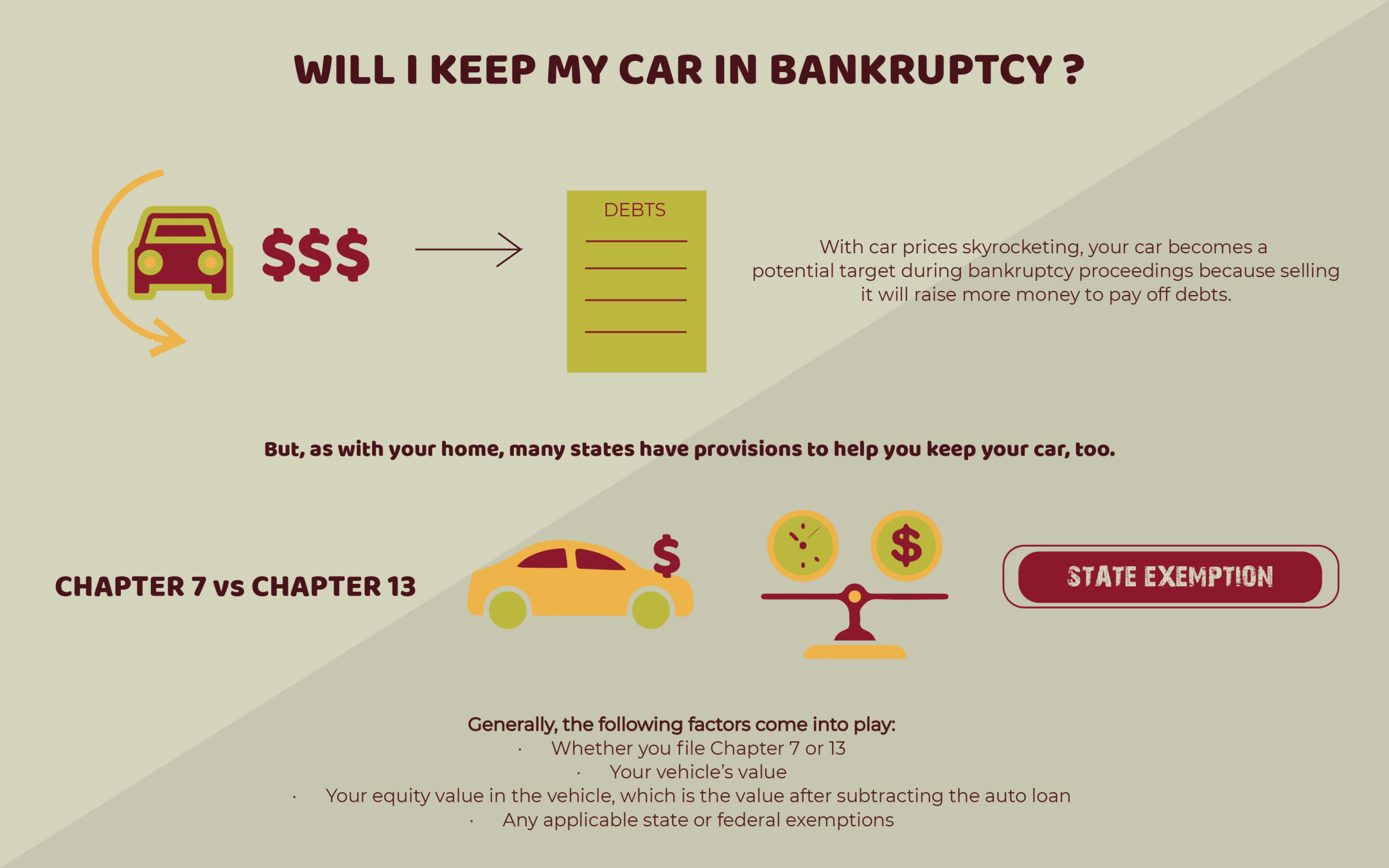

Chapter 13 bankruptcy is a powerful tool for individuals who have regular income and want to repay some of their debts over a period of three to five years. Unlike Chapter 7, where your assets might be sold to pay creditors, Chapter 13 allows you to keep most of your property, including your car, as long as you propose a feasible repayment plan. This means that if you want to continue keeping your car and maintain Chapter 13 car ownership, it’s a very achievable goal.

The Automatic Stay and Your Vehicle

When you file for Chapter 13 bankruptcy, one of the first things that happens is the imposition of the “automatic stay.” This is a legal injunction that immediately stops most collection actions against you by your creditors. This includes repossession attempts for your car. So, if your car is at risk of being repossessed, filing Chapter 13 can immediately halt that process, giving you breathing room to address the situation. This protection is crucial for anyone worried about losing their Chapter 13 vehicle.

Chapter 13 Car Repayment

The core of a Chapter 13 plan involves making regular payments to a bankruptcy trustee, who then distributes the funds to your creditors. To keep your car, you’ll need to demonstrate to the court that you can afford to make these payments.

Making Up Past-Due Payments

If you’ve fallen behind on your car loan, Chapter 13 allows you to “cure” the default by paying the missed payments over the life of your repayment plan. This means you don’t have to pay the entire arrearage all at once, as you might need to if you were trying to catch up outside of bankruptcy. This is a significant advantage for individuals keeping car bankruptcy in mind.

Continuing Regular Payments

In addition to catching up on past-due amounts, you will also typically be required to continue making your regular monthly car payments through the bankruptcy trustee. This ensures that the lender remains current on the loan throughout your repayment period. The ability to manage your Chapter 13 auto loan included in your plan is key to retaining your vehicle.

Situations Where Keeping Your Chapter 13 Car is More Complex

While it’s generally possible to keep your car, there are a few scenarios where it might be more challenging or require specific strategies.

Cars Worth More Than You Owe (Or More Than Exemptions Allow)

In Chapter 7 bankruptcy, there are exemptions that protect a certain amount of equity in your car. If your car’s value exceeds these exemptions, it could be sold. However, in Chapter 13, the focus is on your ability to pay, not necessarily on the car’s equity in the same way as Chapter 7. Still, if your car is significantly valuable and you are proposing to pay less than the full amount of the loan through your plan (which can happen under certain circumstances, explained below), the court will look at the car’s value.

Negative Equity (Owing More Than the Car is Worth)

If you owe more on your car loan than the car is currently worth, Chapter 13 can offer a powerful solution called a “cramdown.”

The “Cramdown” Option in Chapter 13

A cramdown allows you to reduce the principal balance of your car loan to the current market value of the vehicle, as long as the loan was taken out at least 910 days (about 2.5 years) before you file for bankruptcy. You would still need to pay the reduced principal amount through your repayment plan, but you would no longer be obligated to pay the interest on the original, higher loan amount, or any “unsecured” portion of the debt (the amount above the car’s value). This can significantly lower your monthly payments and the total amount you repay for your Chapter 13 vehicle kept.

- Example: Suppose you owe $15,000 on your car, but it’s only worth $10,000. If you qualify for a cramdown, your loan balance for Chapter 13 purposes would be reduced to $10,000. You would then pay this $10,000 (plus applicable interest, which is often set by the court at a lower rate than your original loan) over your repayment plan. The remaining $5,000 would be treated as an unsecured debt and paid according to the terms of your plan, which might be a much lower percentage.

Reaffirming Your Car Loan

In some cases, especially if you are current on your payments and the car is essential, you might choose to Chapter 13 reaffirm car loan. Reaffirming a debt means you are agreeing to remain personally liable for the debt after your bankruptcy case is discharged. This is a voluntary decision, and you must get court approval.

Why Reaffirm?

- Maintain a good credit history: Reaffirming can help you demonstrate to lenders that you are responsible with credit.

- Avoid potential issues with the lender: Some lenders may be more cooperative if you reaffirm, especially if you want to keep the car and are current on payments.

- Keep the original loan terms: If you have a favorable interest rate, reaffirming allows you to keep those terms.

Considerations Before Reaffirming:

- You must be able to afford it: Reaffirming means you are committing to making those payments. If your financial situation changes, you could still face repossession.

- Consult with your attorney: Your bankruptcy attorney can advise you on whether reaffirming is in your best interest.

How Chapter 13 Protects Your Vehicle

Chapter 13 offers several layers of protection for your Chapter 13 vehicle:

- Automatic Stay: Immediately stops repossessions.

- Curing Arrearages: Allows you to pay back missed car payments over time.

- Cramdown: Can reduce the principal balance and interest rate on car loans if you owe more than the car is worth and the loan is old enough.

- Prioritization: Car payments are often treated as secured debts, meaning they are prioritized for repayment within the Chapter 13 plan, increasing your chances of keeping the vehicle.

The Chapter 13 Repayment Plan and Your Car

Your proposed Chapter 13 repayment plan is the blueprint for how you will manage your debts and assets, including your car. When proposing your plan, you will need to outline how you will handle your car loan.

Key Components of the Plan Related to Your Car:

- Treatment of the Secured Car Loan: You will specify whether you are reaffirming the loan, continuing to pay it through the plan, or using a cramdown.

- Arrearages: If you owe back payments, the plan will detail how these will be paid over the 3-5 year term.

- Ongoing Payments: The plan will include your regular monthly car payments.

- Value of the Vehicle: For cramdown purposes, you will need to provide an estimate of the vehicle’s current market value, often supported by an appraisal or Kelley Blue Book (KBB) valuation.

Securing Trustee Approval and Court Confirmation

The bankruptcy trustee and the court will review your proposed plan to ensure it is feasible and complies with bankruptcy law. They will scrutinize your income and expenses to confirm you can afford to make the proposed payments for your car and other debts. If your plan is approved, it becomes legally binding. This confirmation process is vital for keeping your vehicle throughout the bankruptcy.

Can You Buy a New Car While in Chapter 13?

It’s generally possible to purchase a new car while in Chapter 13, but it requires court approval. You’ll need to show that the new vehicle is necessary for your household (e.g., for commuting to work) and that you can afford the payments in addition to your existing Chapter 13 obligations. The court will review the terms of the new loan to ensure they are reasonable.

Chapter 13 vs. Chapter 7 for Keeping Your Car

While both Chapter 13 and Chapter 7 bankruptcy can allow you to keep your car, they do so through different mechanisms.

Chapter 7:

- Focus: Liquidation of non-exempt assets to pay creditors.

- Keeping Your Car: You can keep your car by either:

- Paying the loan in full: If you have the cash.

- Reaffirming the loan: Agreeing to continue payments and remain personally liable.

- Redeeming the car: Paying the car’s current market value in a lump sum.

- Risk: If you cannot afford to do any of the above and the car’s equity exceeds your state’s exemption limits, the trustee may sell the car.

Chapter 13:

- Focus: Reorganization of debts through a repayment plan.

- Keeping Your Car: You can keep your car by:

- Catching up on missed payments within the plan.

- Continuing regular payments through the plan.

- Utilizing a cramdown if you owe more than the car is worth.

- Advantage: Offers more flexibility for those who are behind on payments or have negative equity. It’s a proactive way of Chapter 13 protecting vehicle ownership.

What Happens If You Stop Making Payments During Chapter 13?

If you stop making your required Chapter 13 payments, either to the trustee or your car lender (if you’ve reaffirmed), your car is at risk. The lender can file a motion with the court to lift the automatic stay, which would allow them to repossess the vehicle. Additionally, if you consistently miss payments to the trustee, your entire Chapter 13 case could be dismissed, meaning you lose the protections of bankruptcy.

Frequently Asked Questions (FAQ)

Q1: Can I keep my car if I have two car loans on it and file Chapter 13?

Generally, yes. You will need to address both loans in your repayment plan. If both loans are secured by the vehicle, you’ll likely need to make payments on both. If one of the loans is for more than the car’s value, you might be able to cram down that portion of the debt.

Q2: What if my car is older and has a lot of miles? Can I still keep it in Chapter 13?

Yes, age and mileage typically don’t prevent you from keeping your car in Chapter 13, as long as you can afford the payments as outlined in your repayment plan. The primary concern is your ability to pay the debts.

Q3: Do I need to get rid of my car if it’s not essential for work?

Not necessarily. While it can strengthen your argument to the court that the car is necessary, even if it’s not for work, you can still keep it if you can afford the payments. The court primarily looks at your ability to fund your repayment plan.

Q4: What is the average interest rate for car loans in Chapter 13?

The interest rate on a car loan in Chapter 13 can vary. If you reaffirm the loan, you may keep your original rate. If a cramdown applies, the rate is often set by the court at a rate that reflects the current market conditions for similar loans, which can be lower than your original rate.

Q5: How long does it take to get my car back if it was repossessed before I filed Chapter 13?

If your car was repossessed before you filed Chapter 13, the automatic stay might bring it back. You would then need to include the cost of repossession and any outstanding arrearages in your Chapter 13 plan to get the car released by the lender. This process can take time and requires working closely with your attorney and the lender.

Q6: Can I sell my car during Chapter 13 without permission?

No. You generally need court permission to sell any significant asset, including a car, while in Chapter 13 bankruptcy. This ensures that the sale is conducted in a way that is fair to your creditors.

In conclusion, Chapter 13 car ownership is a very attainable goal for many individuals facing financial hardship. By proposing a realistic repayment plan that addresses your car loan, whether it involves catching up on past-due amounts, making current payments, or utilizing tools like the cramdown, Chapter 13 bankruptcy provides a structured path for keeping your vehicle and regaining financial stability. Consulting with a qualified bankruptcy attorney is essential to navigate the complexities of your specific situation and ensure you make the best decisions for keeping car bankruptcy as a success.