Yes, it is often possible to claim bankruptcy and keep your house and car, but it depends heavily on your specific financial situation and the laws in your state. Bankruptcy is designed to provide a fresh financial start, and this often includes allowing individuals to retain essential assets like a home and a vehicle, provided certain conditions are met.

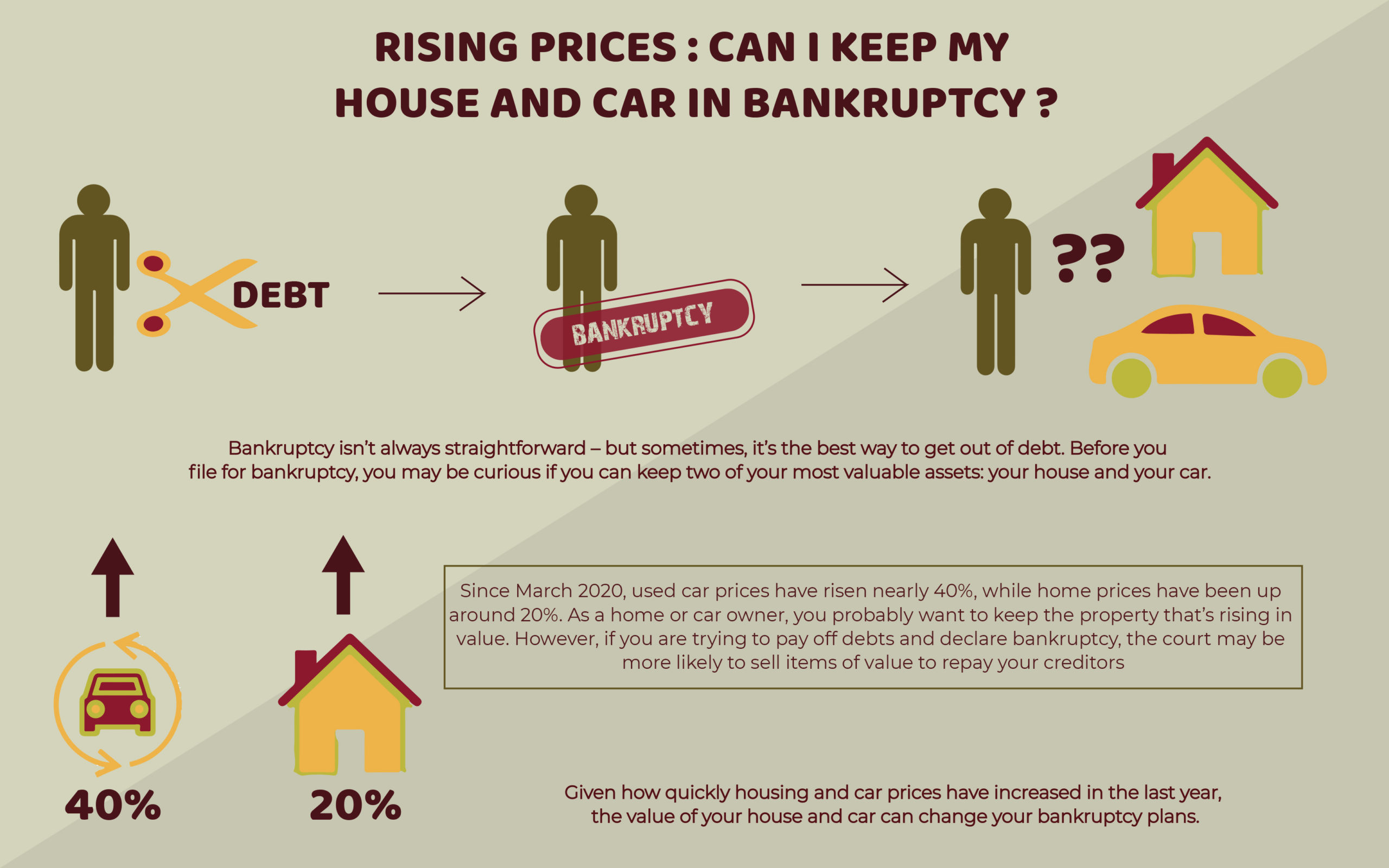

Image Source: www.therollinsfirm.com

Deciphering Your Options: Chapter 7 vs. Chapter 13 Bankruptcy

When you’re facing overwhelming debt, bankruptcy can seem like a daunting prospect. However, it’s a vital legal process designed to help individuals and businesses regain control of their finances. Two primary types of personal bankruptcy are available: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Each offers a different path to debt relief, and the ability to keep your house and car often hinges on which chapter you file under and how you manage your debts.

Chapter 7 Bankruptcy: The Liquidation Path

Chapter 7 bankruptcy, often referred to as liquidation, is the most common form of personal bankruptcy. In this process, a bankruptcy trustee is appointed to sell off your non-exempt assets to pay your creditors. The good news is that not all assets are subject to liquidation. Asset protection is a key component of bankruptcy law, allowing you to keep certain possessions through the use of exemptions.

Property Exemptions: What You Can Keep

Every state has a set of property exemptions that shield specific assets from liquidation. These exemptions vary significantly from state to state, and in some cases, individuals can choose between federal exemptions and their state’s exemptions.

The Homestead Exemption: Protecting Your Home

The homestead exemption is crucial for homeowners. This exemption allows you to protect a certain amount of equity in your primary residence. If the equity in your home is less than the state’s homestead exemption limit, your house is generally protected in a Chapter 7 bankruptcy. However, if your equity exceeds the exemption amount, the trustee might sell your home, pay you the exempted amount, and then distribute the remaining proceeds to your creditors. The value of the homestead exemption can be quite generous in some states, offering substantial protection.

The Motor Vehicle Exemption: Keeping Your Ride

Similarly, the motor vehicle exemption protects a certain amount of equity in your car or other vehicles. Most states have a motor vehicle exemption that allows you to keep at least one vehicle, especially if its value is below a certain threshold. If you have significant equity in your vehicle or own multiple vehicles, you might need to consider paying off the non-exempt portion to the trustee or potentially lose the vehicle.

Secured Debts and Reaffirmation

When you have a house or car with a loan, these are considered secured debts. The house is collateral for the mortgage, and the car is collateral for the auto loan. In Chapter 7 bankruptcy, you have a few options for dealing with secured debts on assets you wish to keep:

- Reaffirmation of Debt: This is a legal agreement where you promise to continue paying a debt that would otherwise be discharged by the bankruptcy. By reaffirming the debt, you essentially agree to keep paying the creditor under the original loan terms. This is a common way to keep your house and car if you can afford the payments and want to avoid repossession or foreclosure.

- Redemption: For personal property like cars, you may have the option to redeem the property by paying the creditor its current market value in a lump sum. This can be a good option if you owe more on the car than it’s worth.

- Surrender: You can choose to surrender the property to the creditor, which releases you from any further obligation on the debt.

The key to keeping your house and car in Chapter 7 is ensuring that the equity in them is covered by your state’s exemptions and that you can continue to make the payments for any secured debts, often through reaffirmation.

Chapter 13 Bankruptcy: The Reorganization Path

Chapter 13 bankruptcy, known as reorganization, is an option for individuals with regular income who want to catch up on missed payments and keep their property, including their house and car. Instead of liquidating assets, you propose a repayment plan to your creditors over a period of three to five years.

The Repayment Plan: How it Works

In a Chapter 13 plan, you make regular payments to a trustee, who then distributes the funds to your creditors. The amount you pay each month is based on your disposable income and the types of debts you have.

- Secured Debts: If you are behind on your mortgage or car payments, Chapter 13 allows you to catch up on these arrears over the life of your plan. This is a significant advantage for those at risk of losing their home or car. You will typically continue to make your regular monthly payments on these secured debts, in addition to paying the past-due amounts through the plan.

- Unsecured Debts: Debts like credit cards, medical bills, and personal loans are considered unsecured debts. In Chapter 13, you pay a portion of these debts based on your disposable income. The remaining balance of most unsecured debts is then eligible for a debt discharge upon completion of your plan.

Protecting Your Assets in Chapter 13

Chapter 13 offers robust asset protection because it’s designed to help you keep valuable property. Even if you have equity in your home or car that exceeds the state exemptions, Chapter 13 can allow you to retain these assets as long as your repayment plan adequately compensates your creditors for their interest in the non-exempt portions of the property. Essentially, your plan must pay at least as much to creditors as they would receive if you filed Chapter 7 and your non-exempt assets were sold.

Factors Influencing Your Ability to Keep Your House and Car

Several crucial factors will determine whether you can successfully keep your house and car through bankruptcy.

Equity in Your Home and Vehicle

As mentioned, the amount of equity you have in your property is a primary consideration. Equity is the difference between the current market value of the asset and the amount you owe on it.

- Home Equity: If you own your home outright or have paid down a significant portion of your mortgage, you may have substantial equity. You’ll need to compare this equity to your state’s homestead exemption to see how much is protected.

- Vehicle Equity: Similarly, if you owe very little on your car or if it’s an older vehicle with low market value, its equity is likely well within the motor vehicle exemption limits.

Loan Arrears

If you are behind on your mortgage or car payments, your situation becomes more complex.

- Chapter 7: In Chapter 7, you generally must be current on your payments or be able to catch up immediately to reaffirm the debt and keep the asset. If you can’t, you might have to surrender the property or risk foreclosure or repossession.

- Chapter 13: Chapter 13 is specifically designed to help you catch up on past-due payments. Your repayment plan will include a component to pay off the missed installments over several years, making it a viable option for those who are behind.

Your Income and Expenses

Your ability to afford the ongoing payments is critical, regardless of the bankruptcy chapter.

- Chapter 7: To keep secured assets in Chapter 7, you must demonstrate to the court that you can afford the regular payments going forward, usually through a reaffirmation agreement.

- Chapter 13: Your income determines your disposable income, which dictates how much you can pay into your repayment plan. A steady income is essential for a Chapter 13 plan’s success.

State Exemption Laws

The specific property exemptions available in your state are paramount. Some states offer very generous exemptions, making it easier to keep high-value assets. Other states have more limited exemptions, requiring more careful planning.

- State-Specific Exemptions: It’s vital to research your state’s specific homestead and motor vehicle exemption limits. These can change, so consulting with a bankruptcy attorney is highly recommended.

- Federal vs. State Exemptions: Some states allow you to choose between federal bankruptcy exemptions and your state’s exemptions. Federal exemptions can be quite broad, but they are not available in all states.

Navigating the Process: Key Steps and Considerations

Filing for bankruptcy involves several important steps and requires careful consideration of your options.

Consulting a Bankruptcy Attorney

The complexities of bankruptcy law, especially concerning asset protection, make it highly advisable to consult with an experienced bankruptcy attorney. An attorney can:

- Assess your financial situation: They can help you determine if bankruptcy is the right option and which chapter best suits your needs.

- Advise on exemptions: They will guide you on which exemptions are available in your state and how to best utilize them to protect your house and car.

- Explain reaffirmation: They can help you understand the implications of reaffirming a debt and whether it’s a wise decision for your financial future.

- Prepare your paperwork: Filing bankruptcy requires meticulous documentation. An attorney ensures all forms are completed accurately and filed on time.

The Bankruptcy Filing and Trustee

Once you file your bankruptcy petition, a trustee is appointed to oversee your case.

- Chapter 7 Trustee: The Chapter 7 trustee’s role is to liquidate non-exempt assets. They will review your filed schedules and may contact you for further information or documentation.

- Chapter 13 Trustee: The Chapter 13 trustee receives your payments and distributes them to your creditors according to your approved plan. They also play a role in confirming your repayment plan with the court.

The Meeting of Creditors

A meeting of creditors, also known as a 341 meeting, is a mandatory part of the bankruptcy process. You will attend this meeting with your attorney (if you have one) and the bankruptcy trustee. The trustee will ask you questions under oath about your financial situation and the information provided in your bankruptcy petition. Creditors may also attend and ask questions, though this is less common in Chapter 7 cases.

Debt Discharge

The ultimate goal of bankruptcy for many is a debt discharge. This is a court order that releases you from personal liability for most of your debts. However, certain debts, such as most student loans, child support, and alimony, are typically not dischargeable.

Can You Keep Your House and Car After Bankruptcy? A Summary

The ability to keep your house and car after filing for bankruptcy is not guaranteed, but it is a realistic goal for many individuals.

| Bankruptcy Chapter | Ability to Keep House & Car | Key Considerations

In essence, keeping your house and car during bankruptcy is achievable by:

- Utilizing appropriate property exemptions: Ensuring the equity in your assets is protected by state or federal law.

- Managing secured debts: Continuing to make payments, often through a reaffirmation agreement in Chapter 7 or within the repayment plan in Chapter 13.

- Having a realistic repayment plan: In Chapter 13, demonstrating you can afford the payments outlined in your proposed plan.

Filing for bankruptcy is a significant decision with long-term implications. Professional legal advice is essential to navigate the intricacies and maximize your chances of a positive outcome.

Frequently Asked Questions (FAQ)

Q1: Can I keep my car if I owe more than it’s worth in Chapter 7 bankruptcy?

A1: You have a few options. You can surrender the car to the lender, which will satisfy the debt. Alternatively, you might be able to redeem the car by paying the lender its current market value in a lump sum, or potentially reaffirm the debt if you can afford the payments and the loan is current.

Q2: What happens to my mortgage if I file Chapter 7 bankruptcy?

A2: If your home’s equity is protected by the homestead exemption and you are current on your mortgage payments, you can usually reaffirm the debt to keep your home. If you are behind on payments or have significant non-exempt equity, you may need to surrender the property or seek alternative solutions.

Q3: Will filing Chapter 13 bankruptcy affect my ability to keep my car?

A3: Chapter 13 is often ideal for keeping vehicles, especially if you have fallen behind on payments. Your repayment plan will include making up the missed payments over time while continuing your regular monthly payments. If your car’s value significantly exceeds what you owe and the state’s motor vehicle exemption, your plan will need to account for the non-exempt equity.

Q4: How much equity can I protect in my home?

A4: The amount of equity you can protect is determined by your state’s homestead exemption laws. These limits vary greatly by state. A bankruptcy attorney can provide specific information for your jurisdiction.

Q5: What are “secured debts” and “unsecured debts”?

A5: Secured debts are debts backed by collateral, such as a mortgage on your house or a loan on your car. If you don’t pay, the lender can repossess or foreclose on the collateral. Unsecured debts are not backed by collateral, like credit card debt or medical bills.

Q6: What is reaffirmation of debt?

A6: Reaffirmation of debt is a personal obligation you voluntarily agree to repay a dischargeable debt after bankruptcy, rather than having it discharged. This is often done to keep secured property like a home or car.

Q7: What is a debt discharge?

A7: A debt discharge is a permanent court order that releases a debtor from personal liability for certain specified debts. It prevents creditors from taking any action to collect discharged debts.

Q8: Are all property exemptions the same in every state?

A8: No, property exemptions vary significantly from state to state. Some states offer more generous exemptions than others, which can impact what assets you can keep during bankruptcy.

Q9: Do I need a lawyer to file for bankruptcy?

A9: While you are not legally required to have an attorney, bankruptcy laws are complex. An experienced bankruptcy attorney can help you navigate the process, protect your assets through proper use of exemptions, and ensure you make informed decisions about reaffirmation and repayment plans.

Q10: What if my car is repossessed before I file for bankruptcy?

A10: If your car was repossessed before you file, it may be more difficult to recover it. However, in some circumstances, particularly in Chapter 13, you might be able to include the costs associated with the repossession and the outstanding loan balance in your repayment plan to get the car back. This is a complex area, and legal advice is crucial.