Yes, you absolutely can finance a car even with bad credit. While it might seem daunting, numerous avenues and strategies exist for obtaining bad credit car loans and navigating auto financing with poor credit. This guide will delve deep into how you can drive away in a new or used vehicle, even when your credit history isn’t perfect.

Image Source: www.credit.com

Getting Approved for a Car Loan with Bad Credit: The Road Ahead

Having a less-than-stellar credit score doesn’t automatically disqualify you from car ownership. The automotive financing landscape is more accommodating than many believe, offering solutions for individuals with various financial backgrounds. The key lies in knowing where to look, what to expect, and how to present yourself in the best possible light. This article will equip you with the knowledge to confidently pursue car financing options for bad credit and increase your chances of approval.

Deciphering Your Credit Score

Before embarking on your car financing journey, it’s crucial to grasp your current credit situation. Your credit score is a three-digit number that lenders use to assess your creditworthiness – essentially, how likely you are to repay borrowed money. Scores typically range from 300 to 850.

- Excellent Credit: 720+

- Good Credit: 660-719

- Fair Credit: 630-659

- Poor Credit: 550-629

- Bad Credit: Below 550

If your score falls into the fair, poor, or bad credit categories, you’ll likely be looking at subprime auto loans. These loans cater to borrowers with lower credit scores and often come with higher interest rates and stricter terms.

Why is My Credit Bad? Common Pitfalls

Several factors can contribute to a low credit score:

- Late Payments: Missing or delaying payments on credit cards, loans, or other bills is a major red flag.

- High Credit Utilization: Using a large portion of your available credit on credit cards can negatively impact your score.

- Debt Collection Accounts: Having accounts sent to collections signals to lenders that you’ve had trouble repaying debts.

- Defaults and Foreclosures: More severe issues like defaulting on loans or facing foreclosure severely damage your credit.

- Limited Credit History: If you have little to no credit history, lenders might see you as a higher risk. This is common for those getting a car loan with no credit or individuals getting car loans for people with no credit history.

- Errors on Your Credit Report: Sometimes, a low score can be due to mistakes on your credit report. It’s wise to check your report for inaccuracies.

Pathways to Financing a Car with Poor Credit

The good news is that securing financing with bad credit is achievable. Here are the primary avenues you can explore:

1. Dealership Financing: The Direct Approach

Many car dealerships have financing departments that work with a variety of lenders, including those specializing in bad credit car dealers and subprime lending. This can be a convenient option as you can handle the car purchase and financing in one place.

How Dealership Financing Works

- In-House Financing: Some dealerships have their own finance companies. They directly lend you the money and handle all payments. These are often referred to as buy here pay here car lots.

- Lender Partnerships: Most dealerships partner with multiple banks, credit unions, and specialized finance companies. They submit your application to these lenders to find the best possible offer.

Pros of Dealership Financing

- Convenience: One-stop shopping for the car and the loan.

- Potentially Faster Approval: Dealerships can often expedite the approval process.

- Relationships with Subprime Lenders: They have established connections with lenders who work with bad credit.

Cons of Dealership Financing

- Higher Interest Rates: Expect higher APRs compared to prime borrowers.

- Limited Negotiation Power: You might have less room to negotiate the price if the dealership bundles financing costs into the vehicle price.

- Focus on the Monthly Payment: Some dealers might push you towards a payment you can afford but stretch the loan term significantly, costing you more in interest over time.

2. Banks and Credit Unions: Traditional Lenders

While banks and credit unions are traditional lenders, they can still be an option for individuals with less-than-perfect credit.

Banks

- Large National Banks: May have stricter approval criteria but can offer competitive rates if you meet them.

- Community Banks: Might be more flexible and willing to work with local customers, even with some credit blemishes.

Credit Unions

- Membership-Based: Credit unions are non-profit organizations, and their primary goal is to serve their members. They often offer more favorable terms and are generally more forgiving with credit issues than large banks.

- Personalized Service: You might find credit unions more willing to discuss your situation and explore options.

Pros of Banks and Credit Unions

- Potentially Better Rates: If you have a fair or slightly poor credit score, you might secure a better rate here than at a dealership.

- Transparency: Loan terms are usually clearly laid out.

Cons of Banks and Credit Unions

- Stricter Approval: They might be less likely to approve applications with very low credit scores.

- Longer Application Process: The approval process can sometimes take longer.

3. Online Lenders and Finance Companies

The digital age has opened up numerous online platforms and specialized finance companies that focus on auto financing with poor credit. These lenders often have more lenient approval requirements.

Online Lenders

- Specialized Lenders: Many companies focus solely on bad credit car loans and subprime auto financing.

- Comparison Tools: Some platforms allow you to compare offers from multiple lenders simultaneously.

Finance Companies

- Direct Lenders: Some finance companies work directly with consumers.

- Brokers: Others act as brokers, connecting you with various lenders.

Pros of Online Lenders

- Accessibility: Apply from the comfort of your home, 24/7.

- Faster Approvals: Many offer pre-approval within minutes.

- Wider Range of Lenders: Access to lenders who specifically cater to bad credit.

Cons of Online Lenders

- Higher Interest Rates: Often the highest APRs due to the increased risk.

- Less Personal Interaction: May lack the face-to-face interaction of a dealership or bank.

- Scrutinize Fees: Be sure to review all associated fees carefully.

4. Buy Here Pay Here (BHPH) Lots

Buy here pay here car lots are dealerships that provide their own financing. They typically work with individuals who have very poor credit or no credit history at all.

How BHPH Works

- In-House Financing: The dealership itself acts as the lender. They approve your loan and collect your payments directly.

- Stricter Payment Schedules: Payments are often due weekly or bi-weekly, coinciding with paychecks.

Pros of BHPH

- High Approval Rates: Almost guaranteed approval, regardless of credit history.

- Direct Relationship: You deal directly with the dealership for all aspects of the loan.

Cons of BHPH

- Very High Interest Rates: These are usually the most expensive loans available.

- Limited Vehicle Selection: Cars on BHPH lots are often older, higher-mileage vehicles.

- Aggressive Collection Tactics: Some BHPH dealers have been known for aggressive collection practices.

- No Credit Building: Payments may not be reported to credit bureaus, hindering your ability to build credit.

5. Co-signer or Co-applicant

If your credit is too low to get approved on your own, or if you want to secure better terms, bringing in a co-signer with good credit can be a highly effective strategy.

What is a Co-signer?

A co-signer is someone with a good credit history who agrees to be equally responsible for the loan. If you miss payments, the co-signer’s credit will be affected, and the lender can pursue them for the debt.

Pros of Using a Co-signer

- Increased Approval Chances: Makes you a much more attractive borrower to lenders.

- Potentially Lower Interest Rates: Can help you qualify for better APRs.

- Helps Build Credit: If payments are made on time, it can help improve your credit score.

Cons of Using a Co-signer

- Risk to the Co-signer: If you default, their credit and finances are impacted.

- Strain on Relationships: Can put a strain on your relationship if you fail to make payments.

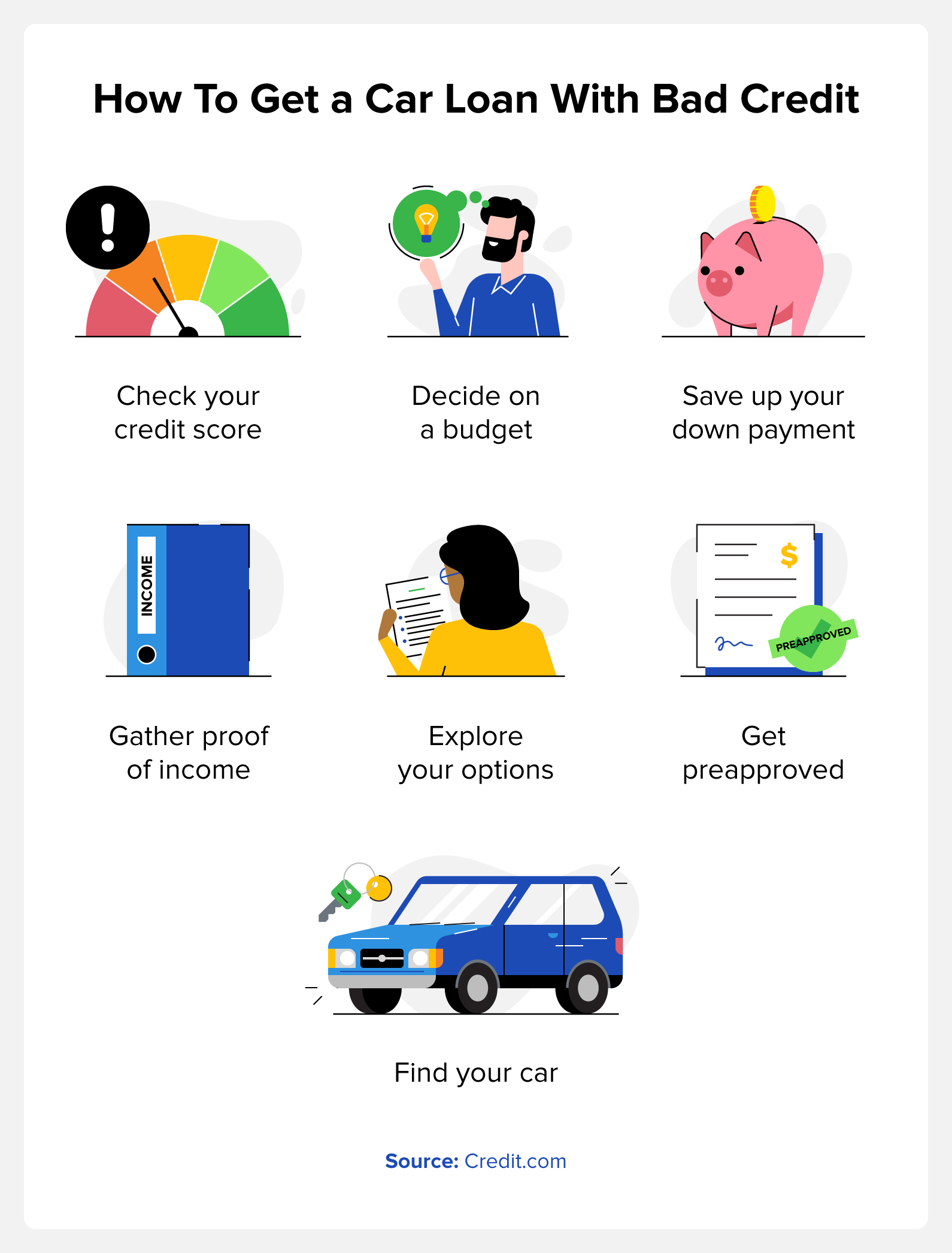

Steps to Take When How to Finance a Car with a Low Credit Score

Here’s a strategic approach to maximize your chances of getting approved:

Step 1: Check Your Credit Report and Score

Before you even start looking for cars, know where you stand.

- Get Free Reports: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com.

- Identify Errors: Review your reports for any inaccuracies that might be dragging down your score. Dispute any errors you find.

- Know Your Score: Many credit card companies or free credit monitoring services provide access to your FICO score.

Step 2: Determine Your Budget

- Affordability: Calculate how much you can realistically afford for a monthly car payment, insurance, fuel, and maintenance.

- Loan-to-Value Ratio: Lenders often look at this. It’s the loan amount divided by the car’s value. A higher down payment reduces this ratio.

- Total Cost: Consider the total cost of the loan, including interest, over the entire loan term.

Step 3: Save for a Down Payment

A larger down payment significantly improves your chances of approval and can help you secure better loan terms.

- Reduces Loan Amount: Less money borrowed means less risk for the lender.

- Lowers Monthly Payments: A smaller principal amount leads to lower monthly payments.

- Improves Loan-to-Value: Makes the loan less risky for the lender.

- Can Offset Bad Credit: It can show lenders you are serious and financially responsible.

Step 4: Research Lenders and Get Pre-approved

Don’t rely solely on dealership financing.

- Online Lenders: Explore specialized online lenders for bad credit car loans.

- Credit Unions: If you’re a member, check with your credit union first.

- Pre-approval: Getting pre-approved from one or two lenders before visiting a dealership gives you a solid benchmark for interest rates and loan terms. It also strengthens your negotiating position. This is a critical step in getting approved for a car loan with bad credit.

Step 5: Choose the Right Vehicle

- Reliability: Opt for a reliable used car from a reputable brand known for longevity. This minimizes future repair costs.

- Affordability: Ensure the car’s price aligns with your budget and the loan you can secure.

- Avoid Overspending: It’s easy to get tempted by newer or more luxurious models, but stick to what you can truly afford.

Step 6: Negotiate the Price of the Car and the Loan Terms Separately

- Car Price First: Negotiate the price of the vehicle before discussing financing.

- Financing Terms: Once the car price is agreed upon, then discuss the loan terms, interest rate, and loan duration. If the dealership’s financing offer isn’t as good as your pre-approval, use it as leverage.

Step 7: Read the Fine Print

Before signing anything, thoroughly review the loan agreement.

- APR: Ensure you know the Annual Percentage Rate.

- Loan Term: Understand how long you will be paying for the car.

- Fees: Watch out for origination fees, administrative fees, or prepayment penalties.

- Guaranteed Asset Protection (GAP) Insurance: This can be beneficial for financed vehicles, especially with higher interest rates, but ensure you need it.

Special Considerations for Getting a Car Loan with No Credit

If you have no credit history, you’re in a slightly different situation than someone with bad credit. Lenders have no data to assess your risk.

- Authorized User: Becoming an authorized user on a trusted person’s credit card can help you establish credit.

- Secured Credit Cards: These require a cash deposit, which acts as your credit limit. Responsible use can build credit.

- Student Loans or Retail Store Cards: Some of these can be easier to get for those with no history.

- BHPH Lots or Bad Credit Dealers: These are often the go-to options for those getting a car loan with no credit history, but be mindful of the high costs.

- Co-signer: As mentioned, this is highly recommended.

Building Credit While Paying Off Your Car Loan

The goal isn’t just to finance a car with bad credit, but to improve your creditworthiness over time.

- Make On-Time Payments: This is the most crucial factor in credit building.

- Keep Credit Utilization Low: If you have other credit cards, manage them responsibly.

- Avoid New Debt: Don’t take on excessive new debt while paying off your car loan.

- Monitor Your Credit: Regularly check your credit reports and scores to track your progress.

FAQs About Financing a Car with Bad Credit

Q1: What is the minimum credit score needed to finance a car?

A1: There isn’t a single minimum credit score. Lenders have different requirements. While scores above 700 are considered excellent, you can still get bad credit car loans with scores in the 500s, though often with higher interest rates. Some specialized lenders and buy here pay here car lots might approve applicants with scores below 500 or even with no credit history.

Q2: Can I get a car loan with no credit history at all?

A2: Yes, it is possible to get a car loan with no credit history. Options include using a co-signer, exploring buy here pay here car lots, or working with lenders that specialize in car loans for people with no credit history. Building credit from scratch requires careful planning and responsible financial behavior.

Q3: Will my interest rate be higher if I have bad credit?

A3: Yes, typically individuals with bad credit are offered higher interest rates (APRs) on auto financing with poor credit. This is because lenders perceive a higher risk of default. The higher your credit score, the lower your interest rate is likely to be.

Q4: How long will it take to pay off a car loan with bad credit?

A4: Loan terms can vary, but for those with bad credit, lenders might offer longer loan terms (e.g., 60 to 84 months) to make the monthly payments more manageable. However, a longer term means you’ll pay more in interest over the life of the loan.

Q5: What are the risks of using a Buy Here Pay Here (BHPH) dealership?

A5: The primary risks of BHPH dealerships include significantly higher interest rates, limited vehicle selection (often older cars with higher mileage), potentially aggressive collection tactics, and the possibility that your payments may not be reported to credit bureaus, hindering your ability to build credit. It’s crucial to weigh these risks against the convenience of guaranteed approval.

Q6: What documents do I need to apply for a car loan with bad credit?

A6: You’ll typically need proof of income (pay stubs, bank statements), proof of address (utility bills, lease agreement), a valid driver’s license, and potentially references. Lenders want to see that you have stable income and residency to support loan payments.

Q7: Can I improve my credit score before applying for a car loan?

A7: Absolutely. While you can secure financing with bad credit, improving your score beforehand can lead to better loan terms and lower interest rates. Steps include paying bills on time, reducing credit card balances, and checking for and correcting errors on your credit report. Even a small improvement can make a difference when getting approved for a car loan with bad credit.

In conclusion, financing a car with bad credit is not an insurmountable challenge. By understanding your options, preparing thoroughly, and employing smart strategies, you can successfully navigate the process and drive away in a vehicle that meets your needs. Remember to prioritize responsible financial behavior to not only obtain a loan but also to improve your credit for future financial endeavors.